Page 23 - Summer 2024

P. 23

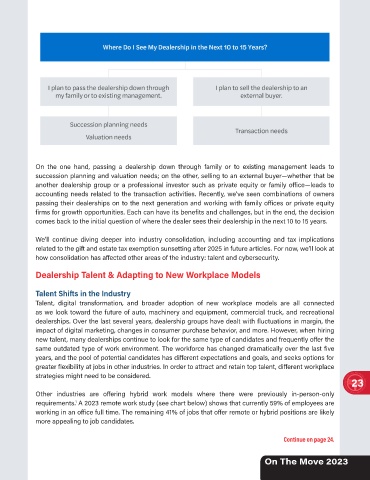

On the one hand, passing a dealership down through family or to existing management leads to

succession planning and valuation needs; on the other, selling to an external buyer—whether that be

another dealership group or a professional investor such as private equity or family office—leads to

accounting needs related to the transaction activities. Recently, we’ve seen combinations of owners

passing their dealerships on to the next generation and working with family offices or private equity

firms for growth opportunities. Each can have its benefits and challenges, but in the end, the decision

comes back to the initial question of where the dealer sees their dealership in the next 10 to 15 years.

We’ll continue diving deeper into industry consolidation, including accounting and tax implications

related to the gift and estate tax exemption sunsetting after 2025 in future articles. For now, we’ll look at

how consolidation has affected other areas of the industry: talent and cybersecurity.

Dealership Talent & Adapting to New Workplace Models

Talent Shifts in the Industry

Talent, digital transformation, and broader adoption of new workplace models are all connected

as we look toward the future of auto, machinery and equipment, commercial truck, and recreational

dealerships. Over the last several years, dealership groups have dealt with fluctuations in margin, the

impact of digital marketing, changes in consumer purchase behavior, and more. However, when hiring

new talent, many dealerships continue to look for the same type of candidates and frequently offer the

same outdated type of work environment. The workforce has changed dramatically over the last five

years, and the pool of potential candidates has different expectations and goals, and seeks options for

greater flexibility at jobs in other industries. In order to attract and retain top talent, different workplace

strategies might need to be considered.

23

Other industries are offering hybrid work models where there were previously in-person-only

requirements. A 2023 remote work study (see chart below) shows that currently 59% of employees are

1

working in an office full time. The remaining 41% of jobs that offer remote or hybrid positions are likely

more appealing to job candidates.

Continue on page 24.

On The Move 2023